In Memoriam: Christine Mendes

With heavy hearts and deep aloha, we remember and honor the life of Christine Mendes, affectionately known to many of us as “Tina.” Her passing on July 9, 2025, leaves a void in our Lōkahi Federal Credit Union ‘ohana, but her legacy of service, kindness, and unwavering dedication lives on in all of us.

Tina became a member of the credit union in 1968 and began volunteering in 2001, serving on several committees including the Supervisory Committee, before eventually joining our Board of Directors in 2009.

Throughout the years, Tina helped to guide the credit union through a time of tremendous growth and change. Under her tenure, we expanded our field of membership to include the entire island of O‘ahu, modernized our services to better serve our members, and rebranded from Hickam Federal Credit Union to Lōkahi Federal Credit Union.

In addition to her leadership, Tina was a constant and cherished presence at our events. Her warm smile and genuine aloha touched everyone she met. To all of us at Lōkahi FCU, she was more than a leader; she was family.

We are deeply grateful for Tina’s decades of selfless service and the love she poured into our community. As we bid her aloha, we carry her spirit forward in the work we do and lives we touch.

Introducing the...Better Together Podcast

We're excited to introduce a new way to stay connected and informed, the Better Together Podcast by Lōkahi Federal Credit Union!

All-New Card Management Portal

Now Available

Take control of your debit and credit cards like never before! An all-new card management portal is now available through Lōkahi FCU Online Banking and the Mobile App. With easy-to-use tools and powerful features, staying on top of your finances is simple, secure, and convenient.

Here’s what you can do with the all-new card management portal:

- Report a lost/stolen card

- Submit travel notifications

- Set or change your card PIN

- Activate a new card

- View your digital card details

- Track spending insights

- Pay your Lōkahi FCU credit card

- View and download credit card statements and transactions

- Request a balance transfer to your Lōkahi FCU credit card

- View merchants where your Lōkahi FCU debit or credit card is saved

- See recurring payments tied to your Lōkahi FCU debit or credit card

- Search transactions with plain-language descriptions

- Download transactions to a spreadsheet

- See your credit card rewards points balance

- Receive enhanced alerts, such as:

- Contact info changes

- New card activations

- Payment due reminders

- PIN or address changes

- Authorized user updates

- And more!

How to Get Started | |

| Access via Online Banking | Access via Mobile App |

|

|

We’re excited to bring you a smarter, simpler, and more secure way to manage your cards—all in one place.

As part of this transition, the Card Control App will be retired in the near future. While no exact date has been set, we encourage you to begin exploring the new card management features within Lōkahi FCU Online Banking and the Mobile App.

If you have any questions, please don't hesitate to contact us at 808.423.1391 or toll-free at 1.800.432.4328.

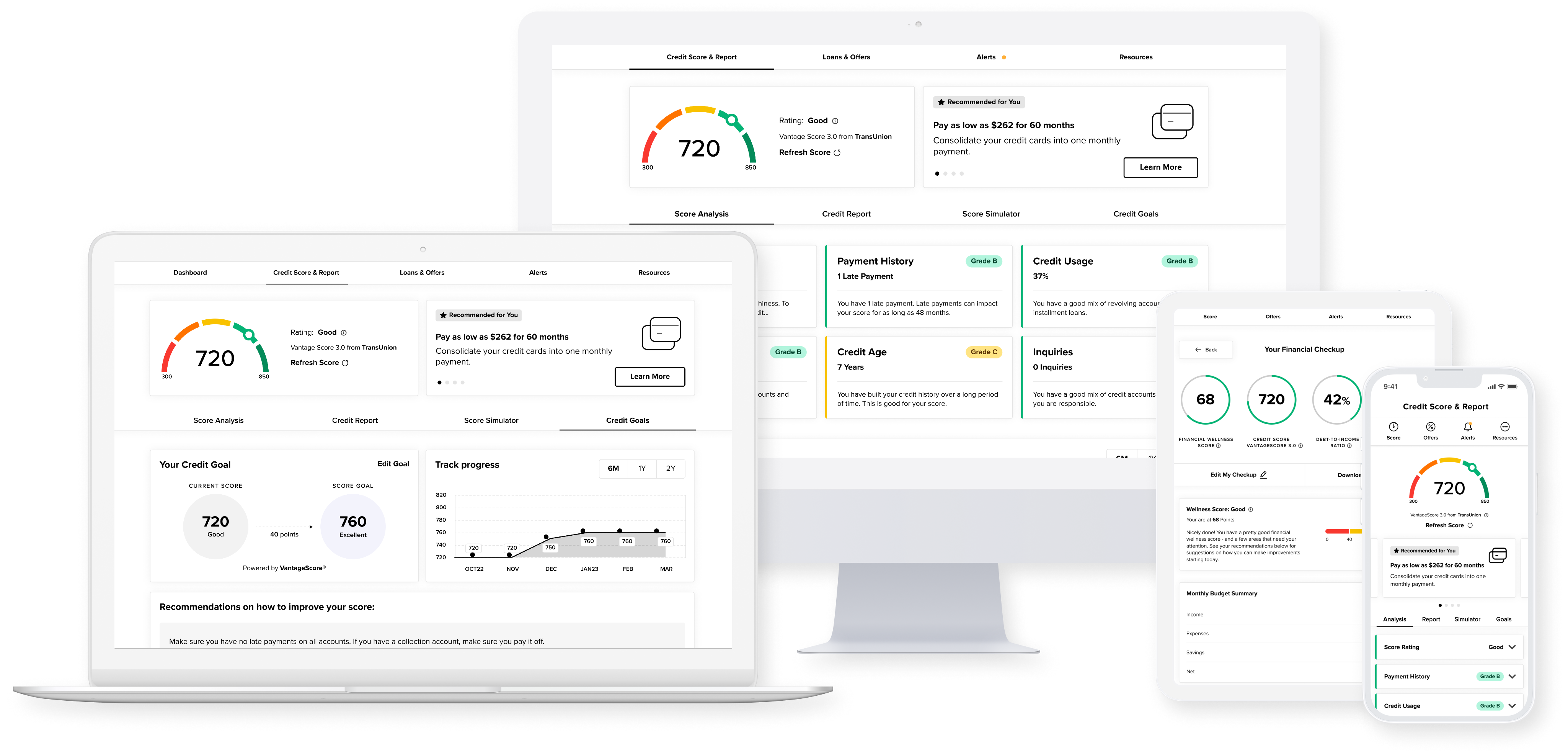

Credit Score & More!

Keeping up with your credit has never been easier! Access your credit score, full credit report, credit monitoring, financial tips, and education with our FREE Credit Score service. With Credit Score, you’ll get:

- Daily access to your credit score

- Real-time alerts for changes to your credit report

- A powerful Credit Score Simulator to explore “what-if” scenarios

- A detailed, personalized credit report

- Special credit offers just for you

- And so much more!

Plus, it’s safe to use—checking your score through this service won’t impact your credit.

Getting started is easy!

Log in to your Lōkahi FCU Online Banking or Mobile app and click "Credit Score" on the navigation bar to enroll today.

When You Need Help,

We're Here For You

At Lōkahi Federal Credit Union, we understand that life doesn't always go according to plan. If you're facing financial challenges or having difficulty keeping up with your bills, reach out to us for help.

Whether it's due to unexpected expenses, a job change, or other life circumstances, you are not alone. Our team is here to listen and work with you to explore solutions that can help ease the burden. We may be able to assist with loan payment options or modifications, budgeting support and financial counseling, and accessing member resources or assistance programs.

The sooner we hear from you, the more we may be able to assist. We aim to help you protect your financial health and stay on track.

Reach out to our dedicated team at 808.423.1391 or toll-free at 1.800.432.4328.

Traveling or Relocating Off Island?

Here’s How to Keep Your Lōkahi FCU Account

Running Smoothly

Whether you’re heading out of state for a vacation or making a big move, it’s important to prepare your Lōkahi FCU accounts before you go. Here are a few key steps to help avoid disruptions and keep your finances secure.

Before You Travel: Let Us Know!

When using your debit or credit card outside of Hawaiʻi, transactions may be flagged as suspicious by our fraud monitoring system. To avoid your card being declined unexpectedly, please notate your travel plans ahead of time:

- Use the card management tools within your Lōkahi FCU Online Banking account or via the Mobile App to notate travel dates

- Send us a secure message through your Lōkahi FCU Online Banking account or via the Mobile App to let us know your travel dates and destinations

- Visit any Lōkahi FCU branch to speak to a representative

- Call us at 808.423.1391.

If You're Relocating: Here Are a Few Things to Keep in Mind

Moving to another state? Stay connected to your accounts and services by doing the following:

- Enroll in Online or Mobile Banking to manage your accounts remotely

- Update your contact information (address, email, phone number) through online banking, at a branch, or by submitting a signed written request if you’ve already moved

- Visit a branch before you depart to obtain your full account numbers

- Check your debit card and wire transfer limits so you’re prepared for future transactions

- Use our Shared Branch Network to access your account from over 5,000 credit union branches nationwide. Find a location near you.

Planning ahead helps protect your account and gives you peace of mind while you travel or settle into a new home. If you have questions, give us a call or stop by—our team is here to help every step of the way.

2025 College Scholarship Winners

Lōkahi Federal Credit Union is proud to support our members' educational journeys. That's why, in 2025, we awarded a total of $10,000 as part of our College Scholarship Program. Our College Scholarship Program Committee selected five deserving students after thoroughly reviewing their applications, transcripts, recommendations, and more. Each student was awarded a $2,000 scholarship. Our 2025 college scholarship recipients are:

- Bryson L., Pre-Medicine

- Misha D., English

- Noah M., Finance

- Sean M., Global Environmental Science

- Siena E., Natural Resources & Environmental Management

Congratulations, and we cannot wait to hear about your future accomplishments!

If you are interested in applying next year, click here to view the requirements.

Volunteer Income Tax Preparation

2025 marks the 18th year Lōkahi FCU staff assisted and prepared tax returns as part of the Volunteer Income Tax Assistance (VITA) program, which provides free income tax preparation services to low-income individuals, individuals with disabilities, and the elderly. From February through April, Lōkahi FCU assisted with processing 91 tax returns, resulting in over $100,000 in federal and over $45,000 in state refunds.

Lōkahi FCU Supports the

Special Olympics Hawaiʻi Summer Games

At Lōkahi Federal Credit Union, giving back to our community is part of who we are. On June 7, a team of dedicated Lōkahi FCU staff and family members proudly volunteered their time at the Special Olympics Hawai‘i Summer Games—an inspiring event that celebrates inclusion, determination, and the power of aloha.

The games brought together hundreds of athletes from across the state to compete in track and field, powerlifting, softball, and more. Our staff joined the effort as event volunteers, assisting with athlete check-ins, event set up, and cheering on the athletes.

Lōkahi FCU is honored to support Special Olympics Hawai‘i and its mission to empower individuals with intellectual disabilities through sports, friendship, and inclusion. We’re proud to stand beside the athletes, their families, and the incredible volunteers who make these events possible.

Mahalo to Special Olympics Hawai‘i for allowing us to be part of such an unforgettable day. We look forward to supporting more events in the future as we continue to live out our values of caring, integrity, and commitment.

Don’t Be Fooled:

How to Avoid Impersonation Scams

Scammers are getting smarter, and one of the most dangerous tactics they use is impersonation. These scams often involve someone pretending to be a trusted source like your credit union, a government agency, tech support, or even a friend or family member in distress. Their goal? To trick you into giving up personal or financial information or sending money.

At Lōkahi FCU, we want to make sure you are able to spot the warning signs and protect yourself and your ‘ohana.

What is an Impersonation Scam?

Impersonation scams happen when a fraudster pretends to be someone you trust. They may:

- Call or text pretending to be from Lōkahi FCU, the IRS, or law enforcement.

- Send fake emails (“phishing”) that look like they’re from a financial institution or a popular company.

- Hack or spoof phone numbers, email addresses, or even social media accounts to appear legitimate.

Their messages often carry urgency—like saying your account is locked, you owe money, or a loved one is in trouble—to pressure you into acting fast.

Here are a few simple ways to stay safe:

1. Don’t Trust Caller ID Alone

Scammers can “spoof” phone numbers to make it look like they’re calling from a legitimate organization—even Lōkahi FCU. If you’re not sure, hang up and call the organization directly using a known number.

2. Never Give Out Personal Info to Unexpected Callers

We will never ask for your full account number, card number, PIN, Social Security number, or online banking password by phone, text, or email.

3. Slow Down and Verify

If someone contacts you with an urgent request for money or information, pause. Whether it’s a friend asking for help via text or someone claiming to be from the IRS—take a moment to confirm through other channels.

4. Be Cautious of Payment Requests

Scammers often ask for payment via gift cards, cryptocurrency, or wire transfers. That’s a red flag. Legitimate organizations won’t ask you to pay this way.

5. Report Suspicious Activity

If you think you've been targeted, contact us immediately at 808.423.1391 or toll-free at 1.800.432.4328 or visit any branch. The sooner you act, the better we can help protect your account.

Did you miss an issue of the Better Together Newsletter? Catch up on past issues here.