With Gratitude and Aloha:

Saying Farewell to Hickam Branch

On March 20, 2026, the Lōkahi Federal Credit Union Hickam Branch, located on Joint Base Pearl Harbor-Hickam, will say "a hui hou" as it permanently closes its doors. While this marks the end of a historical chapter for our credit union, we are deeply grateful for the trust, loyalty, and aloha shared with our Hickam Branch ʻohana over the decades.

In addition to the branch closure, the following Lōkahi FCU ATMs located on Joint Base Pearl Harbor-Hickam will be removed:

- Hickam Branch

- Base Exchange Food Court

- PACAF Building

The Lōkahi FCU ATM located at the Hickam Shopette near Kuntz Gate will remain available.

The decision to close the Hickam Branch and remove select ATMs was not made lightly. After careful consideration of member usage patterns, operational costs, and our long-term strategic goals, we have determined that consolidating our service will allow us to better serve our members through enhanced digital banking options and improved support at nearby locations.

Convenient Banking Options Available:

- 24/7 Digital Banking: Access your account when it’s convenient for you through Lōkahi FCU Online Banking or the Mobile App.

- ATM Access: Enjoy surcharge-free access to the Lōkahi FCU network of ATMs, up to 6 surcharge-free transactions per calendar month at any First Hawaiian Bank ATM, and at over 25,000 CO-OP ATMs ($2 charge for every withdrawal thereafter for the month).

- Shared Branch Locations: Lōkahi FCU is part of a network of over 5,000 Shared Branch locations nationwide and over 70 on Oʻahu. Visit a Shared Branch location to conduct basic transactions just as if you were at a Lōkahi FCU branch. Click here to find Shared Branch locations.

- Nearby Branches: You may continue to access full services at our convenient nearby branches:

| Pearlridge Branch 98-1005 Moanalua Rd, Suite 245 Aiea, HI 96701 Inside Pearlridge Center Mauka near the Ross Wing | Pearl City Branch |

Other convenient branch locations across Oʻahu include:

| Kāhala Mall Kiosk 4211 Waiʻalae Ave Honolulu, HI 96816 Inside Kāhala Mall between Macy's and The Face Shop | Kapolei Branch 590 Farrington Hwy, Suite 501 Kapolei, HI 96707 At Kapolei Marketplace near Doraku Sushi |

| Kāneʻohe Branch 46-056 Kamehameha Hwy Kāneʻohe, HI 96744 Inside Windward Mall across from Ruby Tuesday's | Mililani Branch 95-1249 Meheula Pkwy A-15 Mililani, Hi 96789 At Town Center of Mililani near HIC |

Honoring a Legacy of Service

For decades, our Hickam Branch has proudly served generations of members with care, dedication, and a personal touch that defines who we are as a credit union. We are sincerely grateful for the memories we've made, the relationships we've built, and the trust you've placed in us throughout the years.

As we move forward, we carry this legacy with us and remain committed to honoring the values that have guided us since the beginning.

We understand that change can be challenging, and we are here to support you through this transition. Our team is available to answer any questions and help you explore alternative service options that best meet your needs.

Thank you for your continued trust and membership. We remain committed to providing you with the highest level of service—wherever and however you choose to bank with us.

Introducing Our All-New

Checking Account Lineup!

Whether you're just starting out, managing a busy household, building your financial future, or living life on the go, our all-new checking accounts are designed just for you and your needs.

We've reimagined everyday banking to bring you more flexibility, smarter tools, and features that fit seamlessly into your lifestyle. No matter where life takes you, our new lineup makes it easier to stay connected to your money—your way.

If you currently have a Lōkahi FCU Checking Account, please visit any branch by December 31, 2025, to transition your account to one of our exciting new checking options. Accounts not migrated by this date will be automatically transitioned to our CASH+ Checking.

Don't have a Lōkahi FCU Checking Account yet? Stop by any branch or click link below to explore our all-new checking accounts and open yours today. We're here to help you find the option that best fits your needs!

Learn More About Our Checking Accounts!

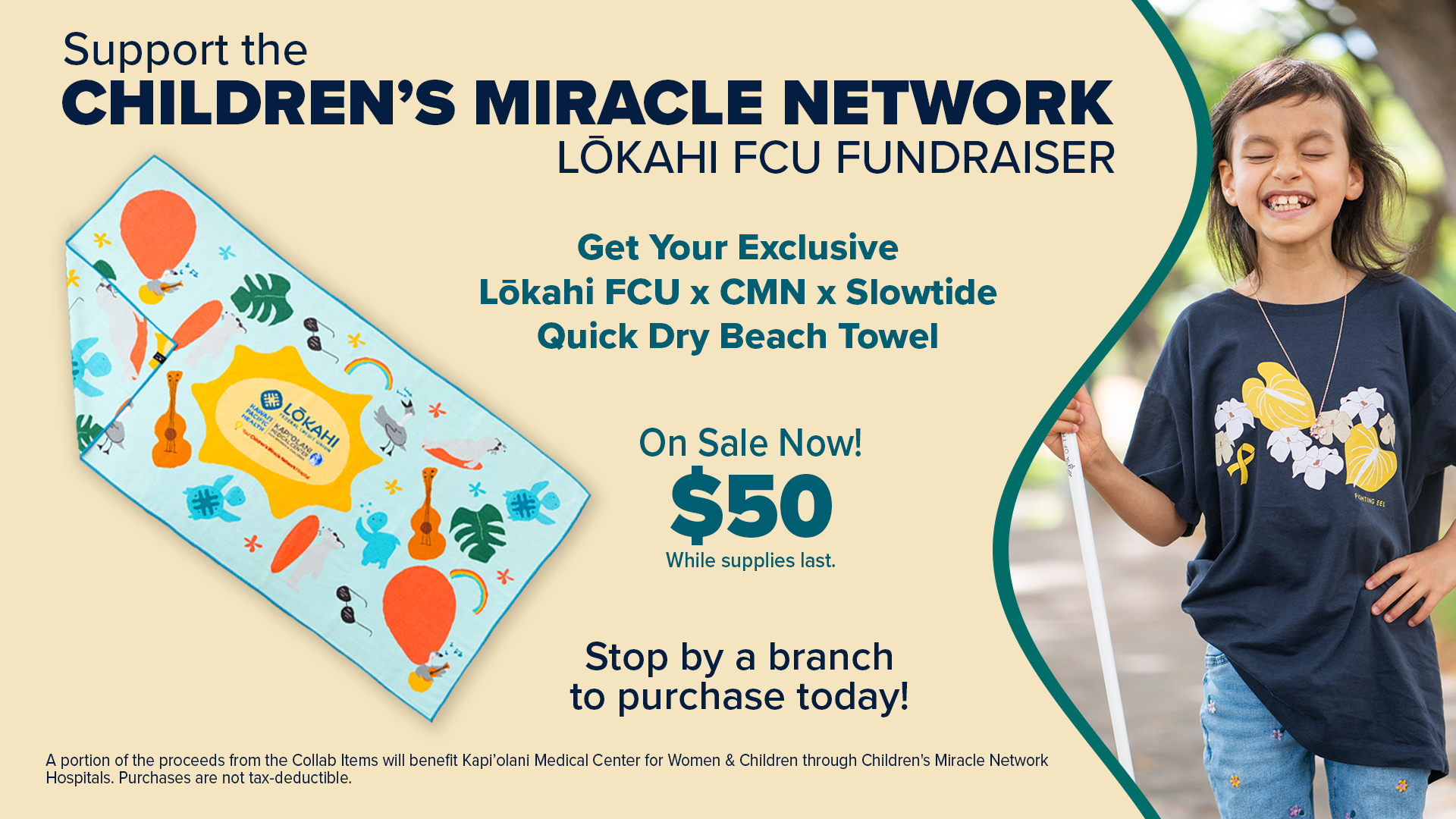

Receive an Exclusive Lōkahi FCU

ALOHA Collection RVS Tote or Slowtide Quick-Dry Beach Towel!

Open a Cash+, Rate+, or Kūpuna Checking account

and receive a special gift—while supplies last!

Choose between a custom-designed ALOHA Collection RVS Tote or a Slowtide Quick-Dry Beach Towel, each featuring exclusive Lōkahi FCU designs crafted by our Marketing Team. To qualify, simply open one of the eligible checking accounts and ensure you receive at least one direct deposit to your account each month.

Limit one gift per member. To qualify, you must open a new Lōkahi FCU Cash+, Rate+, or Kūpuna Checking account and have at least one direct deposit settle to the account. For Cash+ and Rate+ accounts, enrollment in eStatements is also required. The gift—either an ALOHA Collection RVS Tote or a Slowtide Quick-Dry Beach Towel—will be awarded after the first qualifying direct deposit is received. Item selection is subject to availability and may vary. Gifts are available for pickup in-branch only. Offer available while supplies last. Terms and conditions apply. Lōkahi FCU is not affiliated with ALOHA Collection or Slowtide.

ALOHA Collection® and Slowtide® are registered trademarks of their respective owners.

89th Annual Meeting

The Lōkahi FCU 89th Annual Meeting will be held Monday, March 2, 2026. Members will be invited to attend the Annual Meeting at the Pearl City Headquarters. In conjunction with the Annual Meeting, a Membership Appreciation Week will be held online and through our branch locations. Please keep an eye out for the full details in our 1st Quarter 2026 newsletter.

Celebrate International

Credit Union Day

Why do hundreds of millions of people worldwide choose credit unions? Because credit unions have a “people-first” philosophy that impels them to constantly improve their communities and the lives of their members. That local service feeds a worldwide network that reaches more than 411 million members across the globe. On Thursday, October 16, 2025, join credit union and financial cooperative members around the globe in celebrating 77 years of International Credit Union Day®.

To celebrate, we are inviting our members to visit any Lōkahi FCU branch on Thursday, October 16th to receive a free 2026 Pocket Calendar and special treat.*

*Limit one per member while supplies last.

Or, make a monetary donation online.

Traveling Soon?

Set Travel Notifications

to Avoid Card Disruptions!

If you're planning to travel, setting travel notifications for your Lōkahi FCU Debit or Credit Card is now easier than ever. To ensure uninterrupted access to your funds, it's important to notify us of your travel plans in advance. Our fraud monitoring system may flag out-of-state or international transactions as suspicious, which could result in your card being declined unexpectedly. To avoid this inconvenience:

- For trips 20 days or less: Log in to your Lōkahi FCU Online Banking account or the Mobile App, go to Manage Cards, and select Manage Travel Plans.

- For trips lasting over 20 days: Send us a secure message through your Lōkahi FCU Online Banking account or via the Mobile App to let us know your travel dates and destinations.

Check out the latest episode of our Better Together Podcast, where we chat with Reina Miyamoto, Executive Director of the Hawaiʻi HomeOwnership Center, to gain insights into the home-buying process and discover helpful resources to make it easier.

Moving to a New Address?

Keep Us Updated!

Keeping your address up to date is essential to ensure you receive Lōkahi FCU communications, notifications, and financial statements promptly. If you are planning a move or have recently moved, remember to update us with your new address. Hereʻs how you can update your address:

- Update your contact information, such as address, phone number, and email, through Lōkahi FCU Online Banking or the Mobile App.

- For Online Banking: Login to your account, click your name in the upper right corner, select Profile, then choose Contact Information.

- For Mobile App: Login to your account, click on Menu, select Profile, and choose Contact information.

- Submit a signed written request.

- Visit a branch to speak with a representative before your move.

When relocating to a new address, please be aware that postal forwarding services do not apply to mail from financial institutions. If Lōkahi FCU does not have your current address, your mail will be returned to us.

Relocating Without a Permanent Address?

If you do not have a permanent address upon relocating, please contact us:

- Call us at 808.423.1391 or toll-free at 800.432.4328.

- Send us a message via Lōkahi FCU Online Banking or the Mobile App.

Additionally, alert us of your temporary location to prevent your debit or credit cards from being flagged by our fraud monitoring system until you have a permanent address on file. This can be done via Online Banking or the Mobile App. Once logged in to your account, select Manage Cards and then choose Manage Travel Plans.

Upcoming Holiday Schedule

October 13, 2025: CLOSED, Indigenous Peoples’ Day

November 11, 2025: CLOSED, Veterans Day

November 27, 2025: CLOSED, Thanksgiving Day

December 24, 2025: CLOSES at 12:00 p.m., Christmas Eve

December 25, 2025: CLOSED, Christmas Day

December 31, 2025: CLOSES at 12:00 p.m., New Year’s Eve

January 1, 2026: CLOSED, New Year’s Day

ATM Scam Alert:

Beware of Fake Check Scheme

Authorities are urging the public to stay vigilant following a recent surge in ATM scams that have taken a financial toll on their victims.

The scam involves scammers approaching individuals at ATMs with a request to deposit a check in exchange for cash. These scammers often share emotional stories or claim to be in urgent need, offering a "cash tip" as an incentive to gain trust.

In a typical scenario, the scammer hands over a check for $500 and asks the victim to deposit it into their account. Once the ATM receipt confirms the deposit, the victim withdraws $500 in cash and hands it over to the scammer, who then gives the victim a $100 "thank you."

However, within 24 hours, the deposited check is returned due to being drawn on a closed account. The result? The victim loses $400 from their own funds.

To avoid becoming a victim:

- Never deposit checks for strangers.

- Be cautious of emotional appeals or urgent requests at ATMs.

- Report suspicious activity immediately to authorities.

Staying informed and cautious is the best defense against financial fraud.

Did you miss an issue of the Better Together Newsletter? Catch up on past issues here.